Let's Back Up

DOES THIS SOUND LIKE YOU RIGHT NOW?

You spend like it's midnight on Black Friday every day of the week — impulse spending often leading to massive guilt and embarrassment

for you.

You feel constantly torn between living life and trying to save, pay off debt or invest—which leads to feeling like you’re behind where you should

be by now.

You’ve tried to use a budget or plan finances before, but it’s felt restrictive or unexpected things come up and you always end up saying ‘screw it’ and spending even more.

You’ve been chasing more income to get ahead, but as you bring in more dough, your bank account still isn’t reflecting it.

You feel behind. Maybe you feel embarrassed that you aren’t farther ahead by now, or just discouraged about past financial mistakes, but money overall feels so stressful.

You told yourself you were only going to get a credit card for the points + cash back, but somehow ended up with a balance that seems to be growing too fast to manage.

You are proud of the income you have, but are equally embarrassed because you have nothing to

show for it.

Imagine this...

- You trusted your financial decisions and never felt guilty for buying new clothes or booking a vacation (or ordering a second glass of champagne).

- You had no high interest debt (bye, credit cards!) or even no debt at all.

- You felt massively worthy of money coming your way, and knew that your “worst case scenario” is being a millionaire at retirement.

- You never felt restricted and never again told yourself, “I can’t buy that.”

- You felt confident AF when you logged into your investment accounts, because you’ve started or grown them and now you are watching your wealth multiply.

- You never stressed about money. Not only that, but you feel a deep sense of freedom and appreciation for money as a tool to help you reach your goals.

- You never overthink, overanalyze, or obsess over your finances, because you’ve set up systems that automate the process and worked to change your money beliefs.

Welcome To Your New Reality

WHAT WOULD IT FEEL LIKE TO...

So, whats the setup?

The Content

WEEK 1-12

WEEK 7: ATTRACT MASSIVE WEALTH

Week 7 is all about making money feel easy for you, and finally feeling like money flows to you and is always going your way.

WEEK 8: STOP THE SABOTAGE & START ADDING BOUNDARIES

Find out why you get stuck and why you have blocks so that we can break through those barriers and make money moves.

WEEK 9: INVESTING 101

WTF is investing, how do you start and what are all these confusing terms. This week you will learn how to plan to be a millionaire at retirement + invest outside of retirement too.

WEEK 10: WEALTH BUILDING MONEY

Wouldn’t it be nice to know the exact day you’ll be debt free, be able to buy that engagement ring, save enough for a house or take that ballin’ trip to Bali? Week 10 is all about planning out those big future investments so you can start the countdown.

WEEK 11: FUTURE PLANNING

Relationships, buy a car vs. lease a car, buying a house, making babies—woah! How to plan for it all and start making financial decisions for the future.

WEEK 12: FUTURE BAJILLIONAIRE

Before we let you spread your wings into your bajillioniare future, we want to make sure you’re set up for success when life throws you curveballs and unexpected things come up. Week 12 is all about showing you how to get massive results no matter what.

The Coaches

MEET YOUR COACHES

Chloe Elise

HBIC

Chloe Elise (she/her) is the CEO and founder of Deeper Than Money, a global financial literacy company dedicated to empowering and educating people on how to build guilt-free wealth. After paying off over $36,000 of debt in 18 months and becoming debt-free at 22 years old, Chloe watched her life transform as she learned how to build wealth without giving up her lifestyle. Chloe is now on a mission to become a millionaire before she turns 28 years old.

Chloe was born and raised in Iowa, but now lives in Kansas City, Missouri with her two pups, Rosie and Millie. She is a financial expert, host of a top finance podcast, and her work has been featured in The New York Times, NextAdvisor, Yahoo Finance, and MarketWatch, to name a few. Chloe has worked with thousands of clients around the globe to provide education on debt management, investing, and finances through the Deeper Than Money approach- a holistic approach to using money in a way that is emotionally, mentally, and logistically aligned with who we are today and who we want to become. Chloe believes that financial education is more than learning how to budget, pay off debt, or save for retirement. It’s about the freedom that financial stability can provide, being able to live life to the fullest, feel confident, give generously, and improve the lives of those around us.

Investment

If you're excited AF about The Wealth Accelerator, and are looking for the "BUY NOW!" button on this page.... we actually don't have one!

Why? Since not everyone is accepted & we truly want to make sure this program is a good fit for you- we have chosen not to allow you to sign up via our website or list the investment of the program.

On your application call with our team, they will be able to detail the different payment plans we have. We can break up the cost of the program to fit it in your budget.

We also have different discounts or bonuses you may be eligible for! If you're interested at all, we highly recommend you apply, because even if it’s not a good fit for you, we will make sure you leave with a resource in hand (even if it’s one of our free ones!) 😊🫶🏼

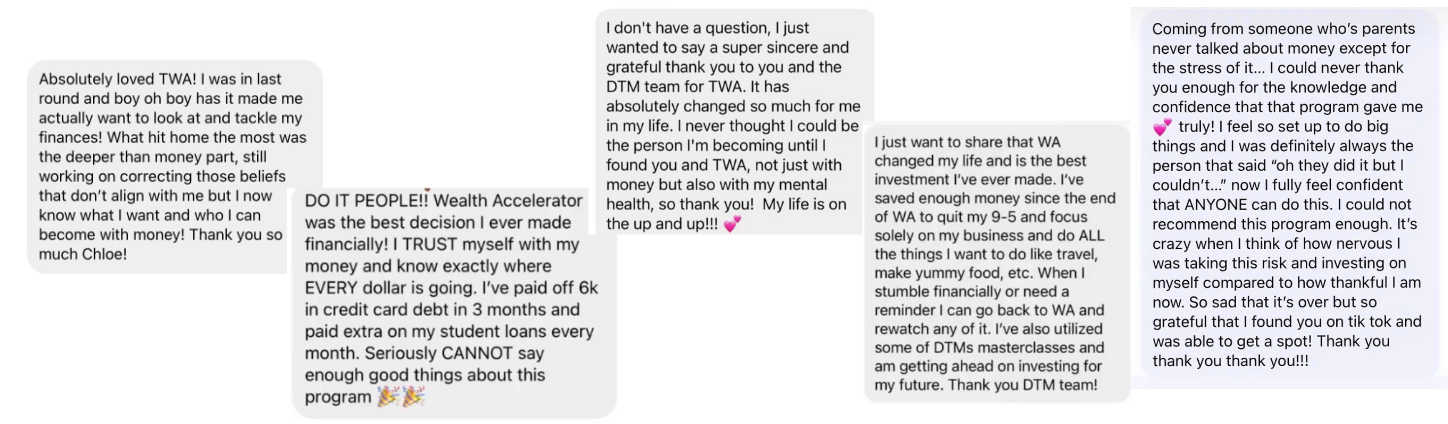

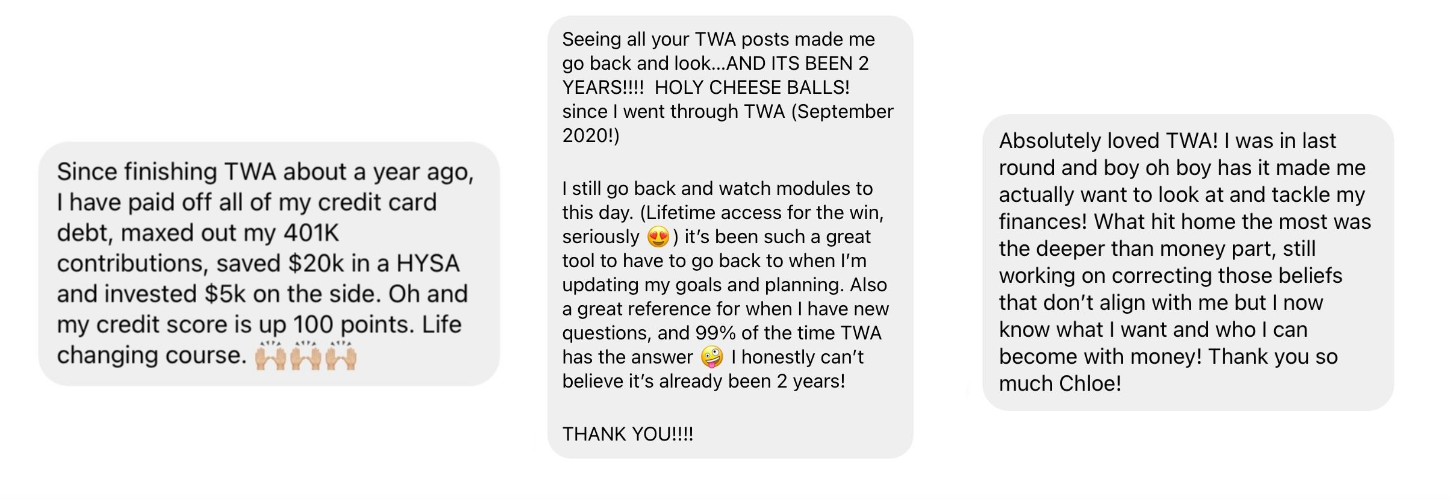

I WANT TO LEARN MORE!Testimonials

HERE IS WHAT OUR ALUMNI HAS TO SAY

“The Wealth Accelerator was by far one of the best experiences of my life. I’ve paid off over $8,000 of credit card debt in the 3 months and have grown so much as a person.”

Apply Now

ENROLLMENT CLOSES APRIL 30TH!

Apply now to be considered for the next round- spots are filling up fast! After filling out your application, you’ll be directed to a link to schedule your application call with our team.

We can’t wait to meet you!

APPLY NOWSide effects may include

CHECKOUT SOME OF THE AMAZING WINS & FEEDBACK OUR ALUMNI HAVE SHARED